DEBT

With nearly $30B in refinancing and acquisitions under our belt, Eastern closes loans of any size, in any location and any property type. We facilitate the loan and negotiate the best rate and terms, and specialize in HUD, Fannie, Freddie, CMBS or Agency loans.

EQUITY

We bring our knowledge of commercial real estate finance and capital market solutions to provide leadership and guidance to your project’s equity requirements.

HEALTHCARE

We service owners and operators of skilled nursing and assisted living/memory care facilities, CCRCs and hospitals nationwide, arranging acquisition loans, bridge and HUD financing, A/R advance lines, cash-outs, partnership buyouts and permanent debt placement.

BRIDGE

With years of experience dealing with Mez and structured loans, Eastern has aggressive leverage and pricing available. Our lenders we work with understand your plan and believe in your deal.

Closed

Loans Secured

Satisfied Clients

Meet Our Healthcare Division

Experience. Service. Closings

Eastern Union’s Healthcare Group services owners and operators of skilled nursing and assisted living/memory care facilities, CCRCs and hospitals nationwide, arranging acquisition loans, bridge and HUD financing, A/R advance lines, cash-outs, partnership buyouts and permanent debt placement.

Led by Nachum Soroka, the group provides valuable insight and custom solutions when sizing up a potential transaction, placing the takeout financing with the best possible terms.

Meet Our Equity Division

Let us help expand your capital network

In today’s environment, it’s crucial to have a trusted advisor that can make the right capital introductions to help you grow your portfolio and close more deals.

At Eastern Equity Advisors we have a proven track record of introductions that have resulted in investments from $500,000 to over $50,000,000.

Launched by Abraham Bergman, the founder of one of the largest commercial mortgage intermediary platforms, today we bring our knowledge of commercial real estate finance, and capital market solutions to provide leadership and guidance to your project’s equity requirements.

Meet Our Structured & Bridge Division

Structured, Bridge & Hard Money Loans

Bridge is king right now. Our Bridge and structured finance department is currently focusing on a multitude of loans from a value-add multi-family acquisition, a vacant office building in Detroit, to a mezzanine loan for a hotel.

We have aggressive leverage and pricing available depending on the product type, and the lenders we work with understand your plan and believe in your deal.

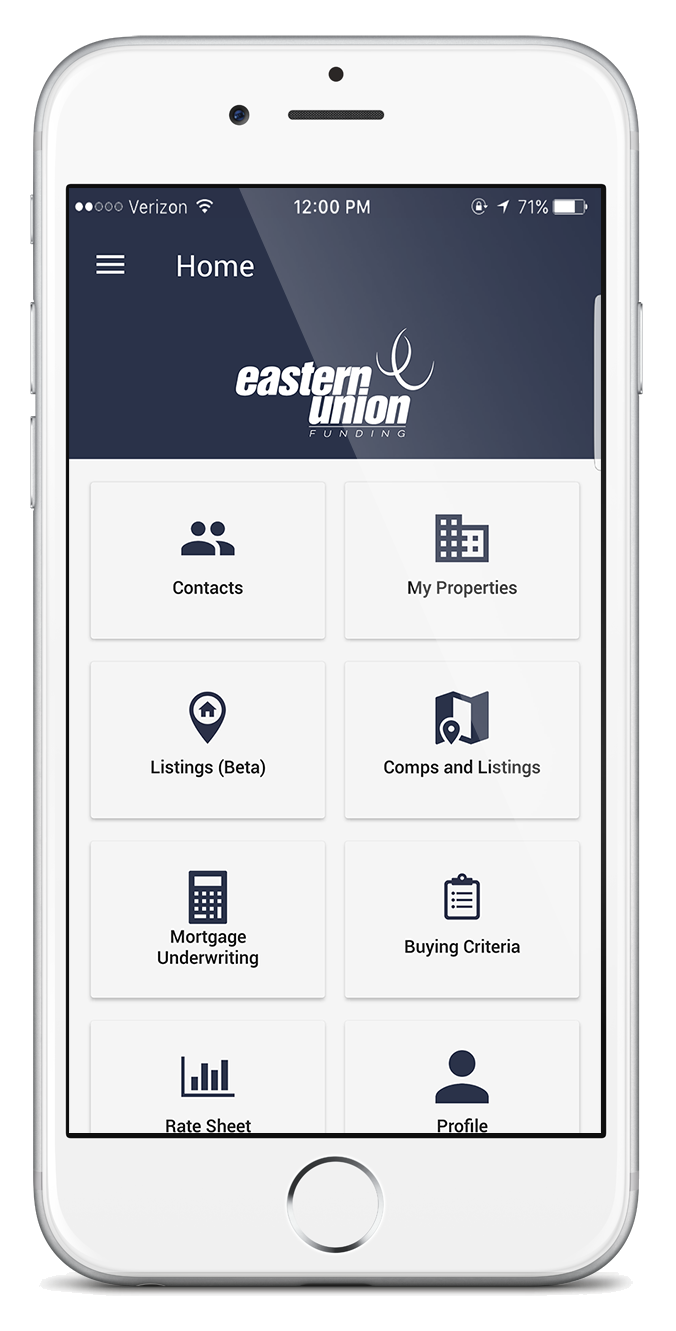

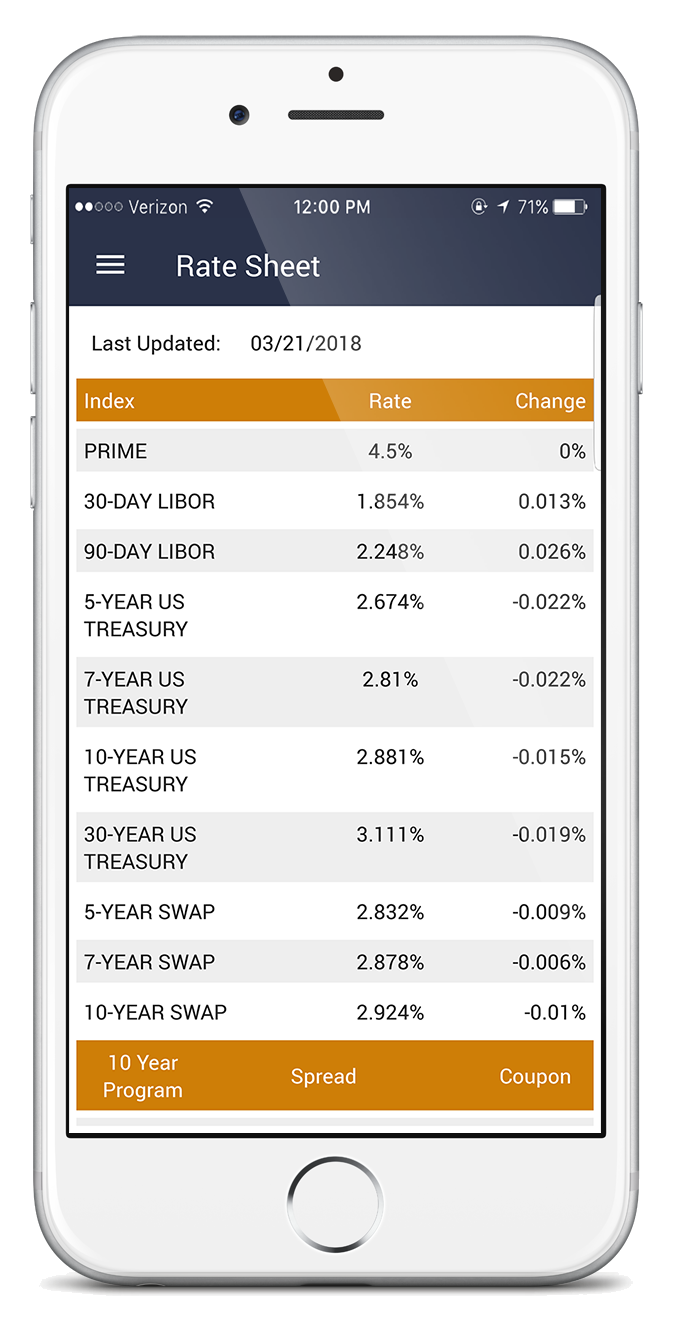

The Eastern Union App is Feature Rich and Completely Free

-

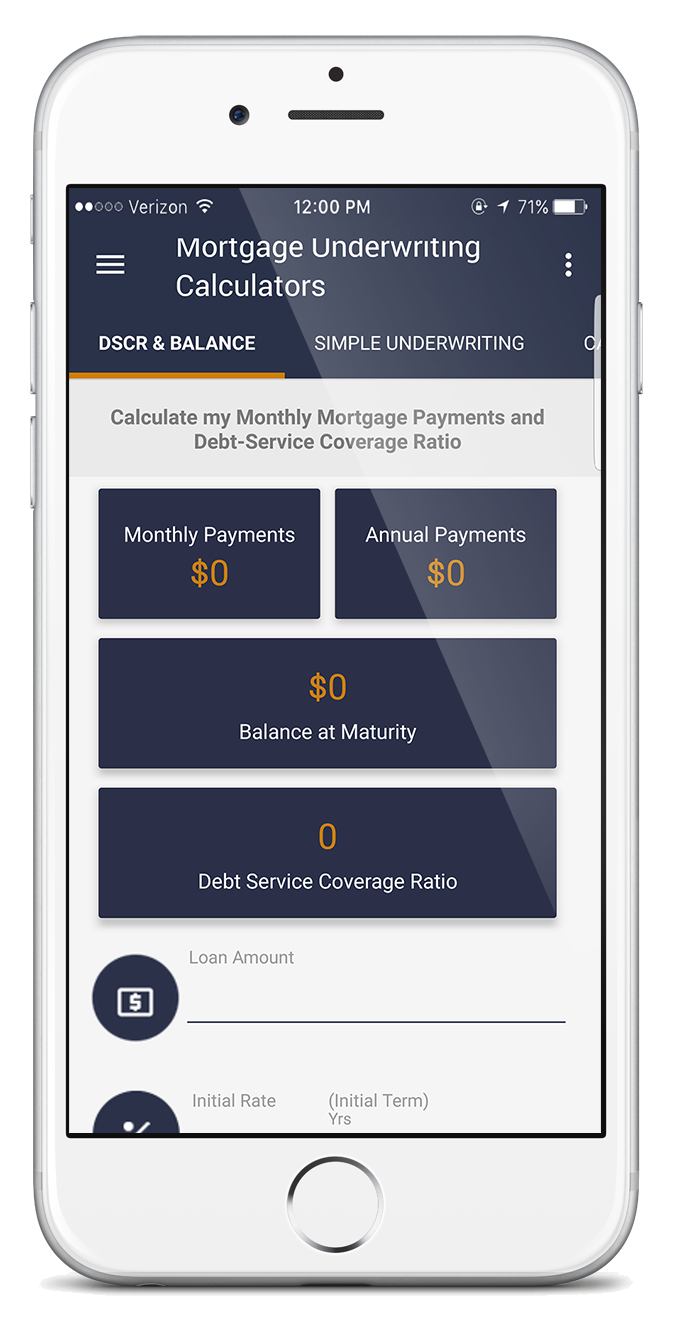

Mortgage Calculator

The most advanced commercial mortgage calculators, including max loan from debt service coverage, cash on cash calculator, basic underwriting and property value calculator using cap rates.

-

Complete CRE Directory

Never have trouble finding the right person with this easily searchable directory containing every vendor you’ll ever need to contact in the commercial real estate business – including bankers!

-

Live Rates

A comprehensive up to date live feed of interest rates, including Fannie, Freddie, SBL, CMBS, as well as 5-, 7-, and 10-year bank rates.

-

CRE News

With Eastern Union’s curated commercial real estate news feed you can get all the latest news you need to stay current, without sifting through hundreds of articles.

-

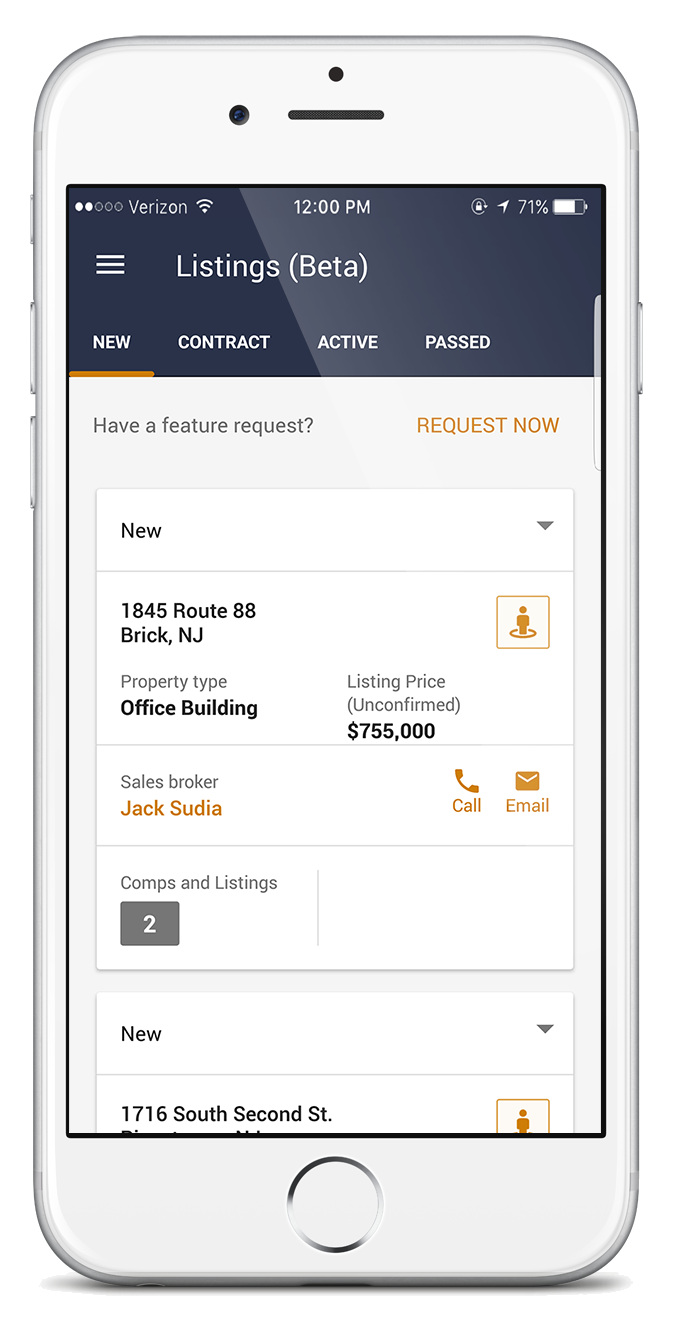

Comps

Access all the comps and listings in your area of interest. Search a specific property and view a map of all the data around that specific address.

Our Offices

NJ Headquarters

455 Oak Glen Road

Howell, NJ 07731

t. 732 301 3900

f. 732 942 5558

747 Chestnut Ridge Rd

Chestnut Ridge, NY 10977

t. 718 567 8400

216 Walworth St

Brooklyn, NY 11205